Trump is Right About Powell, but for the Wrong Reason

Donald Trump has been attacking Federal Reserve Chairman Jerome Powell for years. On this, Trump is right. Powell has been a failure. But not for the reasons Trump gives, and not for the reasons most Americans have been told.

Powell did not fail because interest rates were raised too slowly or cut too late. He failed because he allowed—and directed—one of the most irresponsible expansions of the money supply in modern U.S. history. That single error inflicted lasting damage on tens of millions of Americans.

Inflation is not mysterious. It is not caused by corporate greed, supply chains, oil companies, grocery stores, or geopolitics. Those factors move individual prices up or down. Inflation is something else entirely: a sustained rise in prices across the entire economy. That only happens when too much money is created.

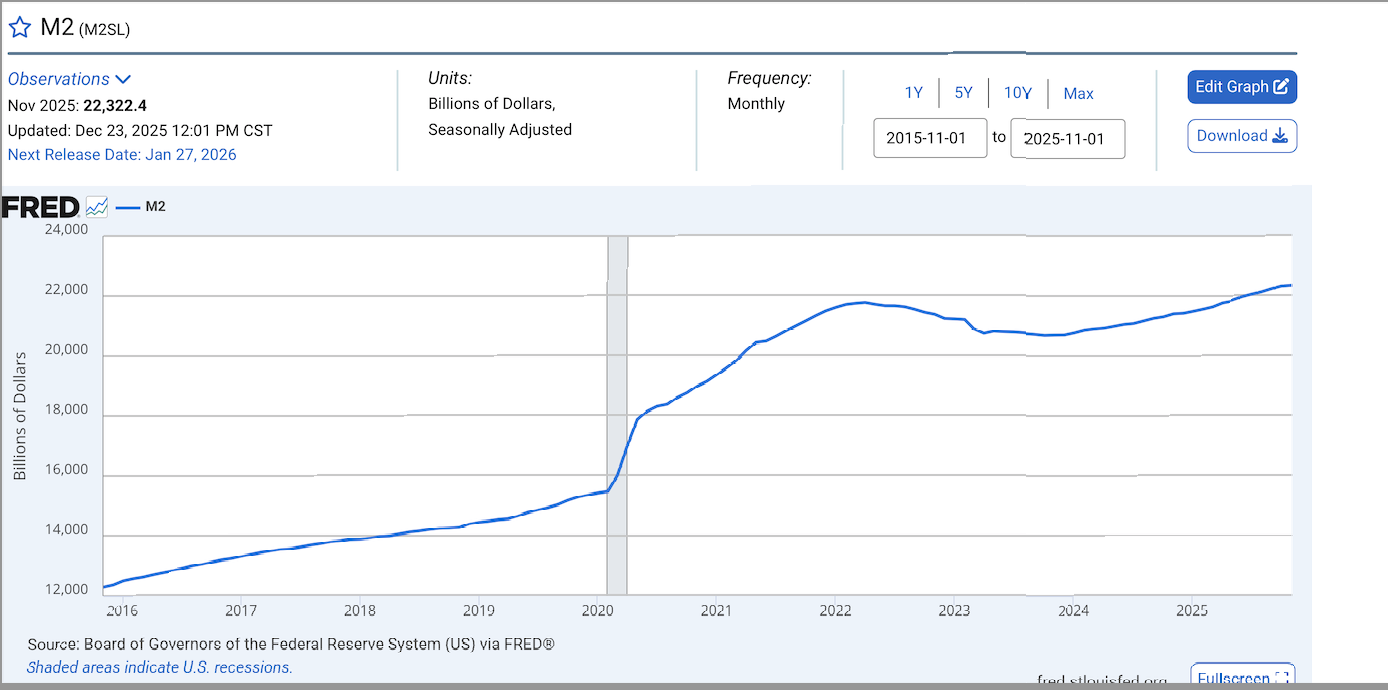

Between 2020 and 2022, the Federal Reserve expanded M2—the broad measure of money in circulation—at a pace never before seen in peacetime America. The chart from the St. Louis Federal Reserve makes this unmistakable. Money supply growth exploded. Inflation followed with a lag, exactly as basic monetary theory predicts.

This was not subtle. This was not hard to foresee. Milton Friedman explained it decades ago: inflation is always and everywhere a monetary phenomenon. Powell ignored that lesson.

The damage from unanticipated inflation is severe and permanent. Prices rose faster than wages. Savings lost purchasing power. Fixed-income households were hit hardest. Retirees, lower-income workers, and anyone living paycheck to paycheck paid the price for a policy error they had no role in creating.

A brief return to sanity followed. The Fed slowed money growth, inflation eased, and the economy began to stabilize. That discipline is now eroding. M2 growth has resumed. The lesson has not been learned.

What makes Powell uniquely dangerous is not just the error itself, but the insulation from accountability. He remains widely praised by journalists and policymakers who do not understand monetary policy. Presidents from both parties have retained him. The biggest economic mistake of the Biden administration was reappointing a chairman whose actions directly caused the inflation Americans are still living with.

This is why reform of the Federal Reserve is not optional. Congress must change the Fed’s mandate. Price stability should be its sole objective. Employment, growth, asset prices, and political convenience should not compete with that goal.

And discretion must be replaced with rules. Authority concentrated in the hands of a few officials invites error, delay, and denial. Rules-based monetary policy constrains mistakes before they become national crises.

Jerome Powell did not merely preside over inflation. He created it. The consequences will be felt for years. Stable money is not a secondary concern. It is the foundation of economic fairness and prosperity.